Simplified commercial insurance quoting for amplified profits

Completing applications to quote commercial business can be time-consuming and disjointed for independent insurance agents, but EZLynx removes the friction and helps you turn time saved into revenue gained. EZLynx takes the guesswork out of building commercial submissions with guided workflows that streamline the way your insurance agency prepares, organizes and tracks all commercial forms and carrier submissions. A single-stream workflow allows you to send applications seamlessly, either directly via APIs for instant quotes or manually via email for collaboration with carrier underwriters. Regardless of your preferred submission method, this workflow saves time and helps you write more business to grow your book profitably.

What can an end-to-end commercial insurance solution do for your agency?

Focused data entry screens and a streamlined submissions workflow provide the efficiency gains needed to thrive in the small-to-medium commercial insurance space.

Powered by Ask Kodiak® technology, a simplified NAICS lookup feature provides appetite and product guidance so you can identify the carriers most likely to underwrite your clients' specific risks.

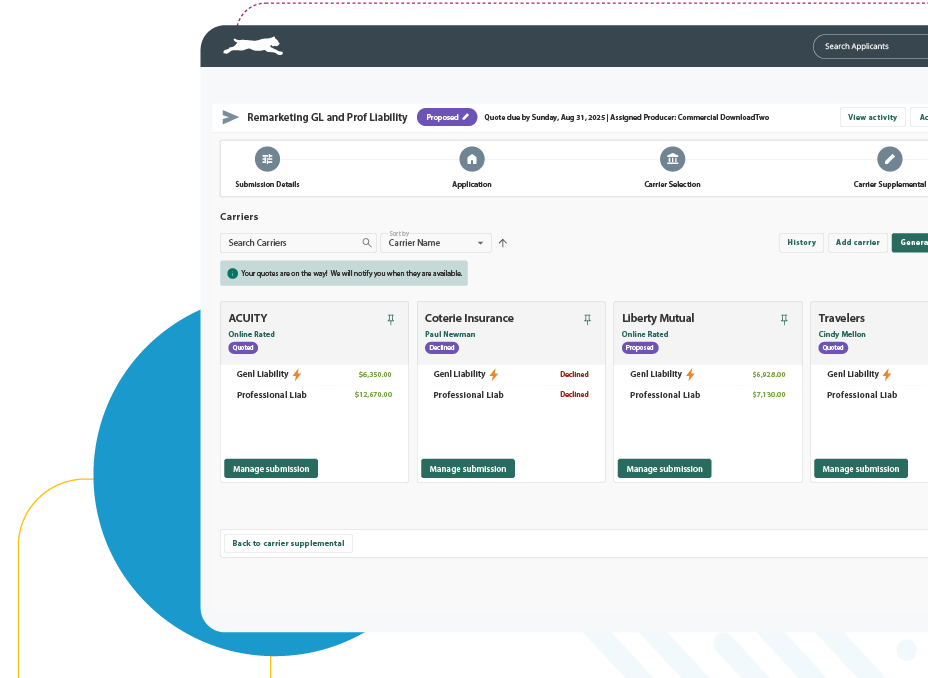

With EZLynx, you can quote multiple lines of business with multiple carriers in real time. A native commercial lines quoting solution eliminates duplicate data entry and increases quote accuracy.

With features like quote comparisons, underwriter communication, ACORD form generation, proposals, and premium financing, EZLynx makes quoting and winning commercial business as simple as possible.

EZLynx lets you track all your carrier submissions and quote results from a single screen. A comprehensive dashboard drives daily tasks and action items critical for moving submissions across the finish line.

EZLynx keeps upcoming renewals front and center, and a complete record of the previous application data, including schedules, means no more starting from scratch year after year.

Resources

-

Maximize Commercial Lines Profits – The Insurance Agent’s How-To

Maximize Commercial Lines Profits – The Insurance Agent’s How-ToLearn how you can leverage the latest tech to streamline tasks, save time, and tap into the full potential of commercial lines.

Read Blog

-

The Benefits of Diversifying Your Book of Insurance

The Benefits of Diversifying Your Book of InsuranceDiscover the benefits of diversifying your book by adding simple commercial lines and find tips for getting started.

Read Blog

Resources

-

Maximize Commercial Lines Profits – The Insurance Agent’s How-To

Maximize Commercial Lines Profits – The Insurance Agent’s How-ToLearn how you can leverage the latest tech to streamline tasks, save time, and tap into the full potential of commercial lines.

Read Blog

-

The Benefits of Diversifying Your Book of Insurance

The Benefits of Diversifying Your Book of InsuranceDiscover the benefits of diversifying your book by adding simple commercial lines and find tips for getting started.

Read Blog